By Andrew Gomes

Advertiser Staff Writer

Salt Lake real estate broker Carol Iseri uncorked the champagne in early December to celebrate what she called a "turning year" for business.

The past 12 months were so good that Iseri, for the first time in five or six years, shared profits with her four nonbroker employees at the 20-agent firm she owns, Properties Unlimited. "It was a very good year," she said.

The number of existing single-family homes and condominiums sold island-wide increased 15.5 percent to 7,107 last year, compared to 6,151 in 1999, according to the Honolulu Board of Realtors. That represented $1.943 billion in transactions, a 21.7 percent increase from $1.596 billion the previous year, the board said.

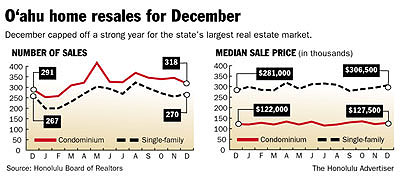

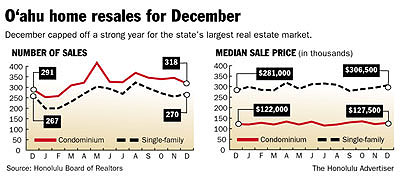

Peter Freeman, the board’s president and chief executive, said the O‘ahu housing market, which represented the majority of statewide resales, had a "very powerful year." The year was capped off by rising prices and sales in December, which typically is a slow month because of the holidays.

Condominium resales rose from 291 in December 1999 to 318 last month, a 9.3 percent increase. The median price rose 4.5 percent, from $122,000 to $127,500 for the same period. (The median price is the point at which half the prices are higher, and half are lower.)

Single-family home resales rose from 267 to 270, or 1.1 percent, for the year-over-year months. The median price rose 9.1 percent, from $281,000 to $306,500.

Herb Conley, co-managing director of Coldwell Banker Pacific Properties, said there was barely time to celebrate amid such a busy December.

Coldwell Banker, one of O‘ahu’s largest residential real estate firms, had its best year since the company was formed in a 1995 merger. Conley said the company assisted slightly more than 2,300 buyers and sellers of property last year.

"The marketplace is as strong as we’ve seen in the last 10 years," he said. "It’s a very healthy market right now."

Freeman said growth in the O‘ahu market has continued for 42 consecutive months. The rate of growth, 15.5 percent, has eased off since 1999 and 1998, during which the growth rate reached 20.0 percent and 24.3 percent, respectively. But the number of transactions was higher.

"The number of sales is now higher than in any year since 1990, the final year of the Japanese bubble period of 1987-90," Freeman said.

Conley said most of the total dollar volume of sales during 2000 is attributable to people buying more units, not simply people paying more for homes. But that will change this year, he predicted, as relatively low inventories push prices higher.

According to brokers, strong market activity occurred in a variety of markets on O‘ahu. "It wasn’t just Kahala that went crazy," Conley said. "It was a wonderfully strong market around the island."

Offering prices frequently were higher than asking prices. Iseri said she noticed that was uncharacteristically true for foreclosure properties owned by banks. Homes in Leeward O‘ahu, where property has been more difficult to sell, also received some higher-than-sought offers, she said.

"It’s certainly a shift that is to be noticed," said Iseri, who said she expects to break out the champagne again at the end of this year. "I expect the market to continue. I see a turnaround in the sellers’ market happening."

[back to top] |