By Andrew Gomes

Advertiser Staff Writer

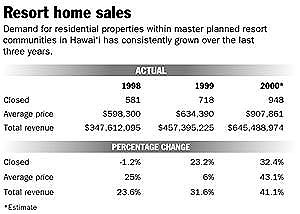

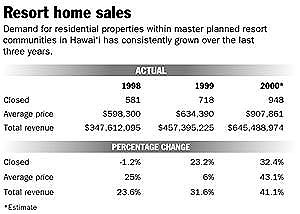

Developers of master-planned resort communities in Hawai‘i sold an estimated $645 million of residential real estate last year, mostly to out-of-state residents who bought property in Wailea, Maui, and on the Big Island’s Kona-Kohala Coast, according to a local market research report.

The report, based on sales of new and existing properties that closed or were expected to close by the end of 2000, shows that wealthy buyers not only want to live in Hawai‘i but also have been willing to pay more to do so. The report, based on sales of new and existing properties that closed or were expected to close by the end of 2000, shows that wealthy buyers not only want to live in Hawai‘i but also have been willing to pay more to do so.

The number of anticipated sales (948), average price ($907,861) and maximum price ($9 million) were all expected to be higher last year than in 1999, according to the report by Honolulu real estate firm Prudential Locations.

"It is a barometer that is important to gauge the attractiveness of our second-home resort plans," said report author Ricky Cassiday.

Bob Rediske, director of marketing and sales at Maluhia At Wailea, a detached condominium project within the Wailea Resort on Maui, said some drops in stock prices early last year didn’t have much impact on buyers of Hawai‘i’s resort-residential real estate.

"With the stock market having gone south for a while, I think a lot of people had been wondering whether (strong resort home sales were) going to hold up or not," he said. "In the upper levels of the market, the fact is that people have not lost enough money to say, ‘Oh, I can’t afford a $10 million house.’ "

Maluhia At Wailea came on the market in August, with 14 homes priced from $6 million to $14 million. Less than a month later, everything was under contract with backups. Sales are expected to start closing this month.

Rediske said he has seen a recent diversification among the homebuying crowd. A couple of years ago, buyers had been almost exclusively dot-com executives from the West Coast. Last year, people in real estate development, manufacturing and investment banking from West Coast and Rocky Mountain states joined the still heavy presence of Internet techies, he said.

"The market in the last couple of years has just been an amazing market," he said.

According to the Prudential Locations report, total revenues from residential property sales within master-planned resort communities statewide grew from almost $348 million in 1998, to about $457 million in 1999, to about $645 million last year.

The average price of each property sold has also consistently increased, from $598,300 in 1998, to $634,390 in 1999, to an expected $907,861 last year.

Wailea was the hottest niche market, with 389 expected closings, followed by Kona at 267, and Kohala at 149.

Condominiums were the most popular purchase. Buyers bought an estimated 588 condos at an estimated average price of $665,442. Vacant land also was a hot commodity, with 273 purchases at an average price of $1.3 million. There were considerably fewer single-family home sales, 87, at an average price of $1.2 million.

[back to top] |